[media-downloader media_id=”2082″ texts=”Download PDF” class=”cherry-btn”]

Index Month / Year to Date

DOW Jones +7.07% / 2.14%

S&P 500 +6.59% / 1.31%

NASDAQ +6.84% / -2.41%

10yr Treasury -0.16% / current yield 1.77%

Markets:

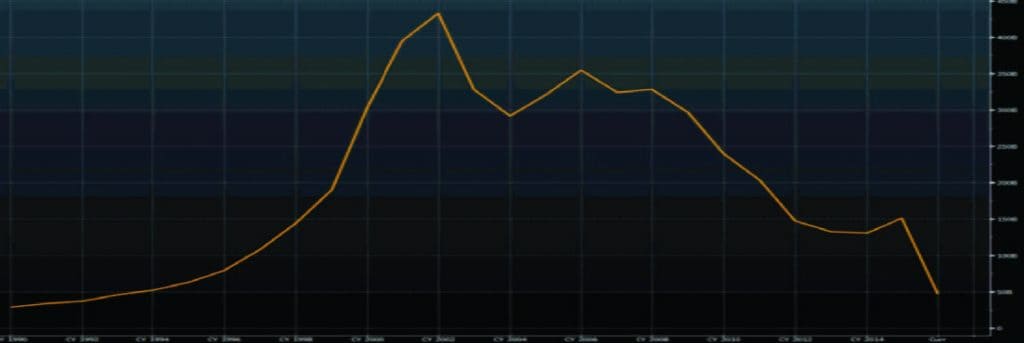

As the weather has begun to warm, so have the equity markets, posting a stellar March return. Unfortunately, as the graphs below will indicate, it has been a thin market with low volume. From 1994 through to 2002, the S&P 500 had a tremendous increase in trading volume with a peak of 432 billion shares in 2002 and materially above-average returns during the ‘90’s. However, post the 2008-crisis trading volume on the S& P500 has fallen back to pre-1994 levels.

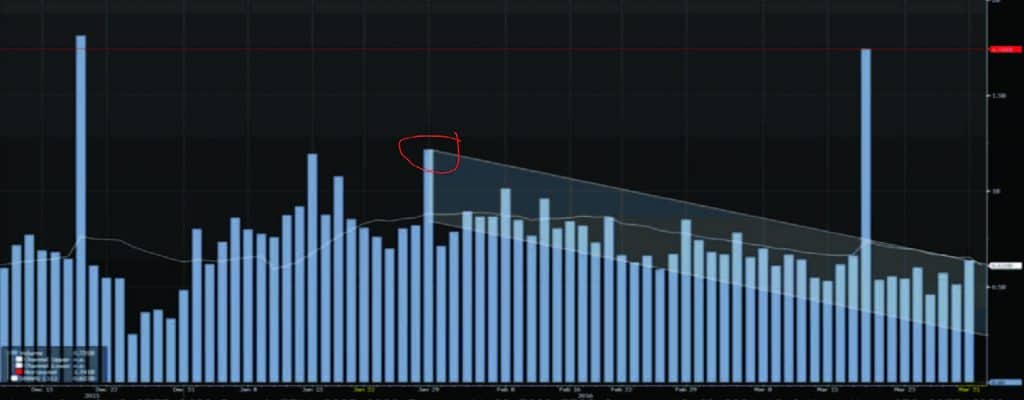

Though March was a great month for equities, volume during the month was probably another warning sign that this equity market is very tired. The second graph will show that the trend in volume is down with March having the lowest volume so far this year. In fact, if it weren’t for companies buying back their stock, we would probably see equity markets deeply in the red. Why is low volume a bad sign you might ask? Well, imagine trying to go faster and further in a car with the gas gauge on almost empty…at some point you’ll hear your significant other telling you how “they told you so” on the side of the road!

S&P 500 trading volume from 1990 through the end of March 2016 (Bloomberg)

S&P 500 trading volume past 3 months; downward trend since January 29th (Bloomberg)

Part of the increase in equities has been tied directly or indirectly to commodity prices such as oil, which ran up to over $41 per barrel from $35 at the beginning of the month. Lack of additional negative news out of China has calmed some fears as well. The ECB (European Central Bank) moved to increase their “quantitative easing” program by increasing their asset purchases to $80 billion Euros per month. It’s been estimated that we’ve had 600 interest rate cuts globally since the 2008 crisis and $12 trillion in asset purchases through central banks! This unprecedented printing of capital has been used to keep large financial organizations solvent, not necessarily as capital for Main Street to invest organically to grow economies. Time will tell if Central Banks and Fortune 500 companies can keep up or increase the pace of their buying financial securities, but at some point, we believe the music will stop and people will scramble for cash and the safest of investments which pay a steady stream of income.

When the equity markets have a great month, sometimes you’ll see a big sell off in bonds; that isn’t the case here as bonds increased in trading volume and price for March. Since we search for bargain-priced income securities and income securities ran

up this month, we don’t have swap trades to report, but we are lining up a swap that may work well for the portfolios by late next week.

You are advised to give independent consideration to, and conduct independent investigation with regards to, the information above in accordance with your individual investment objectives. Use of the Information is at the reader’s risk, is strictly intended for informational purposes in conjunction with the recipient’s due diligence, and should not be construed as a solicitation by Sound Income Strategies, LLC. Past performance will never indicate or guarantee future behavior. Sound Income Strategies, LLC does not represent or warrant that the contents of the document are suitable for you from compliance, regulatory, legal, or any other perspective. We shall have no responsibility or liability for your use or non-use of the document or any portion thereof. Sound Income Strategies, LLC is registered as an investment advisor under the Investment Advisors Act of 1940 and is regulated by the SEC. Sound Income Strategies, LLC and its affiliates may only transact business or render personalized investment advice in those states and jurisdictions where we are registered or otherwise qualified to do so.