Stay Invested, Generate Income

View our recent analysis of FXED vs. AGG performance comparison, for Active vs. Passive fixed income ETFs. View Here

Fund Information

With historically elevated levels of inflation, central banks around the globe reacted by tightening monetary policies last year. The US central bank raised rates so fast they caused several regional banks to close. While we believe now can be a good time to invest in fixed income bonds, bonds can be tricky, you buy on price but get paid on yields, duration matters, and you get taxed on the coupons.

As rates begin to level out and sticky inflationary pressures show signs of subsiding, we believe income investors have an opportunity to re-position portfolios and capitalize on the current macroeconomic environment using the FXED ETF.

Blended corporate credit income strategies like FXED uses, historically the domain of Hedge Funds, could represent a complimentary solution for a 10% allocation in your portfolio, over traditional sources of fixed income.

Utilizing a combination of investment grade and below investment grade debt securities, US Equity Dividend Stocks, BDCs (Business Develop Companies), REITs, and Specialty Bond ETFs of specific segments within corporate bonds that may be poised to benefit in this environment.

FXED’s fixed income management philosophy reflects a goal of consistently outperforming the broader bond market over full market cycles while seeking to maintain below-average volatility with an emphasis on capital preservation.

Sound Enhanced Fixed Income ETF (FXED) is an actively managed exchange-traded fund (ETF) that seeks current income while providing the opportunity for capital appreciation by investing in more tax efficient fixed-income securities than treasury bonds.

Fund Information

| Fund Name | Sound Enhanced Fixed Income ETF |

| Fund Inception | 12/30/20 |

| Ticker | FXED |

| Primary Exchange | NYSE Arca |

| CUSIP | 886364819 |

| NAV Symbol | SDEF.NV |

| Expense Ratio* | 2.12% |

| 30 Day SEC Yield** | 6.76% |

| wdt_ID | New column | New column |

|---|---|---|

| 1 | Fund Name | Sound Enhanced Fixed Income ETF |

| 2 | Fund Inception | 12/30/20 |

| 3 | Ticker | FXED |

| 4 | Primary Exchange | NYSE |

| 5 | CUSIP | 886364819 |

| 6 | NAV Symbol | SDEF.NV |

| 7 | Expense Ratio* | 2.33% |

| Name | date | value |

|---|---|---|

| 30-Day SEC Yield | 06/30/2024 | 6.38 |

| Name | date | value |

|---|---|---|

| 30-Day SEC Yield | 06/30/2024 | 6.38 |

Fund Data and Pricing

| Name |

|---|

| 07/26/2024 |

| Name | value |

|---|---|

| Net Assets | $37.71m |

| NAV | $18.62 |

| Shares Outstanding | 2,025,000.00 |

| Premium/discount Percentage | 0.18% |

| Closing Price | $18.65 |

| Median 30 Day Spread** | 0.38% |

*The Expense Ratio includes management fees and Acquired Fund Fees and Expenses. If Acquired Fund Fees and Expenses were excluded, the Expense Ratio would be 0.49%.

**The 30-Day Yield represents net investment income earned by the Fund over a 30-Day period, expressed as an annual percentage rate based on the Fund’s share price at the end of the 30-Day period. The 30-Day unsubsidized SEC Yield does not reflect any fee waivers/reimbursements/limits in effect.

Performance

| Name |

|---|

| 06/30/2024 |

| Fund Name | Fund Ticker | 1 Month | 3 Month | 6 Month | YTD | 1 Year | 3 Year | 5 Year | Since Inception Cumulative | Since Inception Annualized | Date |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Sound Enhanced Fixed Income ETF | FXED NAV | 0.23 | 0.26 | 3.39 | 3.39 | 11.57 | 1.23 | – | 10.97 | 3.02 | 06/30/2024 |

| Sound Enhanced Fixed Income ETF | FXED MKT | 0.16 | -0.41 | 2.40 | 2.40 | 11.47 | 1.06 | – | 10.76 | 2.97 | 06/30/2024 |

| Bloomberg U.S. Universal Bond Index | BCUNIV | 0.91 | 0.19 | -0.28 | -0.28 | 3.47 | -2.68 | – | -8.82 | -2.60 | 06/30/2024 |

| Name |

|---|

| 06/30/2024 |

| Fund Name | Fund Ticker | 1 Month | 3 Month | 6 Month | YTD | 1 Year | 3 Year | 5 Year | Since Inception Cumulative | Since Inception Annualized | Date |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Sound Enhanced Fixed Income ETF | FXED NAV | 0.23 | 0.26 | 3.39 | 3.39 | 11.57 | 1.23 | – | 10.97 | 3.02 | 06/30/2024 |

| Sound Enhanced Fixed Income ETF | FXED MKT | 0.16 | -0.41 | 2.40 | 2.40 | 11.47 | 1.06 | – | 10.76 | 2.97 | 06/30/2024 |

| Bloomberg U.S. Universal Bond Index | BCUNIV | 0.91 | 0.19 | -0.28 | -0.28 | 3.47 | -2.68 | – | -8.82 | -2.60 | 06/30/2024 |

| As of January 31, 2023 (Cumulative) | As of December 31, 2022 (Annualized) | |||||||

| MTD | QTD | YTD | QTD | YTD | 1 Year | 3 Year | Since Inception | |

| Market Price | 7.43% | 7.43% | 7.43% | 5.79% | -14.69% | -14.69% | – | -3.03% |

| Fund NAV | 8.65% | 8.65% | 8.65% | 4.38% | -15.22% | -15.22% | – | -3.49% |

| Index | 3.10% | 3.10% | 3.10% | 2.24% | -12.99% | -12.99% | – | -7.19% |

Performance Returns Calendar Year

| YTD 2023 | |

| Market Price | 7.43% |

| Fund NAV | 8.65% |

Distribution Detail

| Ex-Date | Record Date | Payable Date | Amount |

|---|---|---|---|

| 07/25/2024 | 07/25/2024 | 07/29/2024 | 0.0400 |

| 07/11/2024 | 07/11/2024 | 07/15/2024 | 0.0400 |

| 06/25/2024 | 06/25/2024 | 06/27/2024 | 0.0400 |

| 06/11/2024 | 06/11/2024 | 06/13/2024 | 0.0400 |

| 05/29/2024 | 05/29/2024 | 05/31/2024 | 0.0400 |

| 05/13/2024 | 05/14/2024 | 05/16/2024 | 0.0400 |

| 04/25/2024 | 04/26/2024 | 04/30/2024 | 0.0400 |

| 04/11/2024 | 04/12/2024 | 04/16/2024 | 0.0400 |

| 03/26/2024 | 03/27/2024 | 03/28/2024 | 0.0400 |

| 03/12/2024 | 03/13/2024 | 03/15/2024 | 0.0400 |

Top 10 Holdings

| Name |

|---|

| 07/29/2024 |

| Date | Account | SecurityName | StockTicker | CUSIP | Shares | Price | MarketValue | Weightings | NetAssets | SharesOutstanding | CreationUnits | MoneyMarketFlag |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 07/29/2024 | FXED | AT&T Inc | 00206R706 | 00206R706 | 36,592 | 20.12 | 736,231.04 | 1.95% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | AEGON Funding Co LLC | 00775V104 | 00775V104 | 36,275 | 21.15 | 767,216.25 | 2.03% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | Allstate Corp/The | 020002838 | 020002838 | 35,248 | 21.92 | 772,636.16 | 2.05% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | American Axle & Manufacturing Inc 5% 10/01/2029 | 02406PBB5 | 02406PBB5 | 717,000 | 91.96 | 659,363.38 | 1.75% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | Apache Corp 5.1% 09/01/2040 | 037411AW5 | 037411AW5 | 789,000 | 86.95 | 685,997.79 | 1.82% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | Associated Banc-Corp | 045487402 | 045487402 | 34,221 | 20.15 | 689,553.15 | 1.83% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | Bank of America Corp | 06053U601 | 06053U601 | 36,038 | 23.31 | 840,045.78 | 2.23% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | CMS Energy Corp | 125896845 | 125896845 | 35,170 | 24.41 | 858,323.85 | 2.28% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | Capital One Financial Corp | 14040H782 | 14040H782 | 37,935 | 19.04 | 722,282.40 | 1.92% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | Cleveland-Cliffs Inc 5.875% 06/01/2027 | 185899AH4 | 185899AH4 | 731,000 | 99.85 | 729,905.25 | 1.94% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | Dana Inc 4.25% 09/01/2030 | 235825AH9 | 235825AH9 | 599,000 | 88.62 | 530,814.57 | 1.41% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | Dell Inc 6.5% 04/15/2038 | 24702RAF8 | 24702RAF8 | 616,000 | 106.45 | 655,733.23 | 1.74% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | EQM Midstream Partners LP 5.5% 07/15/2028 | 26885BAC4 | 26885BAC4 | 711,000 | 99.68 | 708,745.28 | 1.88% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | Hilton Domestic Operating Co Inc 4.875% 01/15/2030 | 432833AF8 | 432833AF8 | 782,000 | 96.69 | 756,144.26 | 2.01% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | JPMorgan Chase & Co | 48128B648 | 48128B648 | 34,537 | 25.31 | 874,131.47 | 2.32% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | MetLife Inc | 59156R850 | 59156R850 | 36,117 | 20.58 | 743,287.86 | 1.97% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | Morgan Stanley | 61762V804 | 61762V804 | 37,066 | 22.35 | 828,425.10 | 2.20% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | Morgan Stanley | 61762V861 | 61762V861 | 35,942 | 18.78 | 674,990.76 | 1.79% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | Murphy Oil Corp 5.875% 12/01/2027 | 626717AM4 | 626717AM4 | 868,000 | 100.06 | 868,521.23 | 2.30% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | National Fuel Gas Co 4.75% 09/01/2028 | 636180BP5 | 636180BP5 | 789,000 | 98.46 | 776,841.68 | 2.06% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | Olin Corp 5.125% 09/15/2027 | 680665AJ5 | 680665AJ5 | 789,000 | 97.72 | 770,987.52 | 2.04% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | Radian Group Inc 4.875% 03/15/2027 | 750236AW1 | 750236AW1 | 789,000 | 98.58 | 777,802.78 | 2.06% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | Southern Co/The | 842587800 | 842587800 | 35,881 | 22.30 | 800,168.73 | 2.12% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | Southwestern Energy Co 4.75% 02/01/2032 | 845467AT6 | 845467AT6 | 500,000 | 93.30 | 466,484.80 | 1.24% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | Targa Resources Partners LP / Targa Resources Partners Finance Corp 5% 01/15/2028 | 87612BBG6 | 87612BBG6 | 789,000 | 99.22 | 782,812.90 | 2.08% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | Truist Financial Corp | 89832Q745 | 89832Q745 | 35,407 | 22.66 | 802,322.62 | 2.13% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | United Rentals North America Inc 4.875% 01/15/2028 | 911365BG8 | 911365BG8 | 727,000 | 97.61 | 709,614.09 | 1.88% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | Wells Fargo & Co | 94988U128 | 94988U128 | 37,698 | 20.40 | 769,039.20 | 2.04% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | Apple Hospitality REIT Inc | APLE | 03784Y200 | 9,819 | 14.99 | 147,186.81 | 0.39% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | Ares Capital Corp | ARCC | 04010L103 | 59,017 | 20.95 | 1,236,406.15 | 3.28% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | AllianceBernstein Global High Income Fund Inc | AWF | 01879R106 | 100,427 | 10.57 | 1,061,513.39 | 2.82% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | Blackstone Secured Lending Fund | BXSL | 09261X102 | 13,000 | 30.75 | 399,750.00 | 1.06% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | iShares J.P. Morgan EM High Yield Bond ETF | EMHY | 464286285 | 25,409 | 37.54 | 953,853.86 | 2.53% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | First American Government Obligations Fund 12/01/2031 | FGXXX | 31846V336 | 997,301 | 100.00 | 997,301.25 | 2.64% | 37,706,917 | 2,025,000 | 81 | Y |

| 07/29/2024 | FXED | Golub Capital BDC Inc | GBDC | 38173M102 | 70,910 | 15.45 | 1,095,559.50 | 2.91% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | Gaming and Leisure Properties Inc | GLPI | 36467J108 | 2,567 | 49.45 | 126,938.15 | 0.34% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | HERCULES CAPITAL INC | HTGC | 427096508 | 68,698 | 21.43 | 1,472,198.14 | 3.90% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | VanEck Emerging Markets High Yield Bond ETF | HYEM | 92189F353 | 38,054 | 19.40 | 738,247.60 | 1.96% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | National Health Investors Inc | NHI | 63633D104 | 2,668 | 75.07 | 200,286.76 | 0.53% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | NNN REIT Inc | NNN | 637417106 | 6,221 | 45.52 | 283,179.92 | 0.75% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | Realty Income Corp | O | 756109104 | 7,429 | 58.07 | 431,402.03 | 1.14% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | Omega Healthcare Investors Inc | OHI | 681936100 | 10,612 | 36.30 | 385,215.60 | 1.02% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | Invesco Emerging Markets Sovereign Debt ETF | PCY | 46138E784 | 38,380 | 20.30 | 779,114.00 | 2.07% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | PennantPark Floating Rate Capital Ltd | PFLT | 70806A106 | 94,046 | 11.41 | 1,073,064.86 | 2.85% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | Alpine Income Property Trust Inc | PINE | 02083X103 | 21,328 | 17.26 | 368,121.28 | 0.98% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | Park Hotels & Resorts Inc | PK | 700517105 | 13,821 | 14.93 | 206,347.53 | 0.55% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | Plymouth Industrial REIT Inc | PLYM | 729640102 | 21,819 | 24.22 | 528,456.18 | 1.40% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | Runway Growth Finance Corp | RWAY | 78163D100 | 41,243 | 12.01 | 495,328.43 | 1.31% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | iShares 0-5 Year High Yield Corporate Bond ETF | SHYG | 46434V407 | 25,962 | 42.63 | 1,106,760.06 | 2.94% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | Simon Property Group Inc | SPG | 828806109 | 4,644 | 152.45 | 707,977.80 | 1.88% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | Sixth Street Specialty Lending Inc | TSLX | 83012A109 | 47,379 | 21.01 | 995,432.79 | 2.64% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | VICI Properties Inc | VICI | 925652109 | 17,081 | 30.88 | 527,461.28 | 1.40% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | WhiteHorse Finance Inc | WHF | 96524V106 | 45,020 | 12.19 | 548,793.80 | 1.46% | 37,706,917 | 2,025,000 | 81 | |

| 07/29/2024 | FXED | Cash & Other | Cash&Other | Cash&Other | 83,809 | 1.00 | 83,809.12 | 0.22% | 37,706,917 | 2,025,000 | 81 | Y |

Our Sales Team

Eastern and Western Territories

James McConaghy

Director, Head of Distribution - Western Division

(954) 516-0824

jmcconaghy@soundincomestrategies.com

Edward Rumell

Director, Head of Distribution - Eastern Division

(954) 640-415

erumell@soundincomestrategies.com

How to purchase our ETFs

Sound Income Strategies FXED ETF is available through various channels including via phone (833) 916-9056, broker-dealers, investment advisors, and other financial services firms, including:

Sound Income ETFs

Before investing you should carefully consider the Fund’s investment objectives, risks, charges and expenses. This and other information is in the prospectus. A prospectus may be obtained by calling (833) 916-9056 or viewing here. Please read the prospectus carefully before you invest.

Investing involves risk, including the potential loss of principal. There is no guarantee that the Funds investment strategy will be successful. Shares may trade at a premium or discount to their NAV in the secondary market. The Fund is new and has a limited operating history. The Fund has a limited number of financial institutions that are authorized to purchase and redeem shares directly from the Fund; and there may be a limited number of market makers or other liquidity providers in the marketplace. Since the Fund is actively managed it does not seek to replicate the performance of a specified index. The Fund may frequently trade all or a significant portion of its portfolio; and have higher portfolio turnover than funds that do seek to replicate the performance of an index. Securities rated below investment grade are often referred to as high yield securities or “junk bonds.” Investments in lower rated corporate debt securities typically entail greater price volatility and principal and income risk. High yield securities may be more susceptible to real or perceived adverse economic and competitive industry conditions than investment grade securities.

The Fund may, at times, hold illiquid securities. The Fund could lose money if it is unable to dispose of an illiquid investment at a time or price that is most beneficial to the Fund. The Fund’s investments in bonds and other debt securities will change in value based on changes in interest rates. If rates rise, the value of these investments generally declines. Securities with greater interest rate sensitivity and longer maturities generally are subject to greater fluctuations in value. The Fund is considered to be non-diversified, which means that it may invest more of its assets in the securities of a single issuer or a smaller number of issuers than if it were a diversified fund.

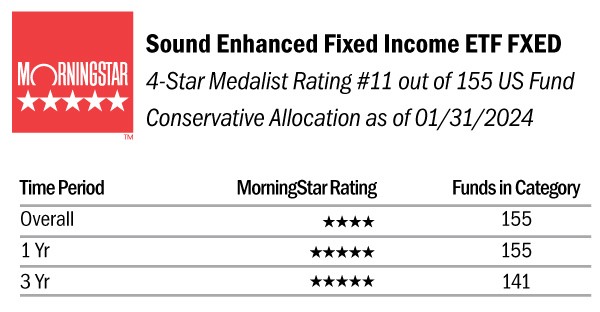

The Morningstar Rating™ for funds, or “star rating”, is calculated for managed products (including mutual funds, variable annuity and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product’s monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of products in each product category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its three-, five-, and 10-year (if applicable) Morningstar Rating metrics. The weights are: 100% three year rating for 36-59 months of total returns, 60% five-year rating/40% three-year rating for 60-119 months of total returns, and 50% 10-year rating/30% five-year rating/20% three-year rating for 120 or more months of total returns. While the 10-year overall star rating formula seems to give the most weight to the 10-year period, the most recent three-year period actually has the greatest impact because it is included in all three rating periods.

The Fund is distributed by Foreside Fund Services, LLC.