[media-downloader media_id=”2047″ texts=”Download PDF” class=”cherry-btn”]

Investment Markets:

October turned out to be a very pleasant month for equities, with the DOW and S&P returning over 8%, bringing the S&P to just

less than 1% and the DOW closer to breaking-even on the year. Last month’s rally helped ease the pain of the brutal August sell-off, but reading through the 3rd QTR revenue and earnings releases, you’d think that equities would be flat to slightly negative.

Healthcare being the exception, most sectors missed top-line revenue estimates. However, we can’t discount financial accountants’

abilities to turn a revenue miss into an earnings hit – with a little help from Wall Street’s sell-side coverage lowering the earnings

expectations bar to push stocks a little higher.

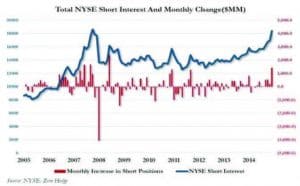

However, last month was a stellar month, and the graph below might help explain part of the buying frenzy. It would appear that

increasing short-interest positions (speculators selling shares they don’t own) from August and September was doing some covering

(buying back shares to close out their short-interest position) in October. There are still above average short positions that speculators

(betting the market goes down) haven’t closed out. NYSE shorts have been between 12 and 13 billion this year until the August

through October period when they jumped to 14-15 billion per Bloomberg.

The first week in October was the first time during the past nine weeks that short positions fell. We believe this rally might be a good

time to take some stock profits off the table, lower risk, and look for the next set of opportunities from income-generating securities.

The Fed has expressed a bit of a stronger view that household and business spending are increasing at a more “solid” pace, bringing

the possibility of a rate increase at its December 16th meeting. This has pushed yields up roughly three-tenths of 1% in the intermediate

part of the curve and presents some buying opportunities in fixed income. We will continue looking for higher yields, reduced interest rate risk, and credit upgrade opportunities in the weeks to come.

You are advised to give independent consideration to, and conduct independent investigation with regards to, the information above in accordance with your individual investment objectives. Use of the Information is at the reader’s risk, is strictly intended for informational purposes in conjunction with the recipient’s due diligence, and should not be construed as a solicitation by Sound Income Strategies, LLC. Past performance will never indicate or guarantee future behavior. Sound Income Strategies, LLC does not represent or warrant that the contents of the document are suitable for you from compliance, regulatory, legal, or any other perspective. We shall have no responsibility or liability for your use or non-use of the document or any portion thereof.

Sound Income Strategies, LLC is registered as an investment advisor under the Investment Advisors Act of 1940 and is regulated by the SEC. Sound Income Strategies, LLC and its affiliates may only transact business or render personalized investment advice in those states and jurisdictions where we are registered or otherwise qualified to do so.